Organisations oppose State move to impose new levy on cereal exports

By Maureen Kinyanjui |

Starting July 1, 2024, the government intends to operationalise the food crops regulations gazetted in 2019, imposing new levies on the import and export of various food crops.

The Kenya National Chamber of Commerce and Industry (KNCCI) and the Cereal Growers Association (CGA) have opposed the recent 0.3 per cent levy on cereal exports imposed by the Agriculture and Food Authority (AFA).

The organisations in a joint statement released on Thursday argued that the levy could undermine the agricultural sector, which is a vital part of the Kenyan economy.

Keep reading

- Security agencies are independent, my office doesn’t interfere – Ruto

- Finance Bill protests: Rights groups warn against potential internet shutdown, media disruptions

- Protesting Gen Zs reject Ruto's promise of dialogue on Finance Bill

- Finance Bill protests: Pressure mounts over whereabouts of content creator Crazy Nairobian

"The agriculture sector is the backbone of our economy, contributing 21.8 per cent to the GDP and being the second-largest employer in the private sector. This levy threatens to reverse the gains made in promoting agricultural exports, making our produce less competitive in international markets," reads the statement in part.

Starting July 1, 2024, the government intends to operationalise the food crops regulations gazetted in 2019, imposing new levies on the import and export of various food crops.

This means that cereals, legumes, pulses and roots or tubers will be subject to tax as announced by the Agriculture and Food Authority (AFA) on Tuesday.

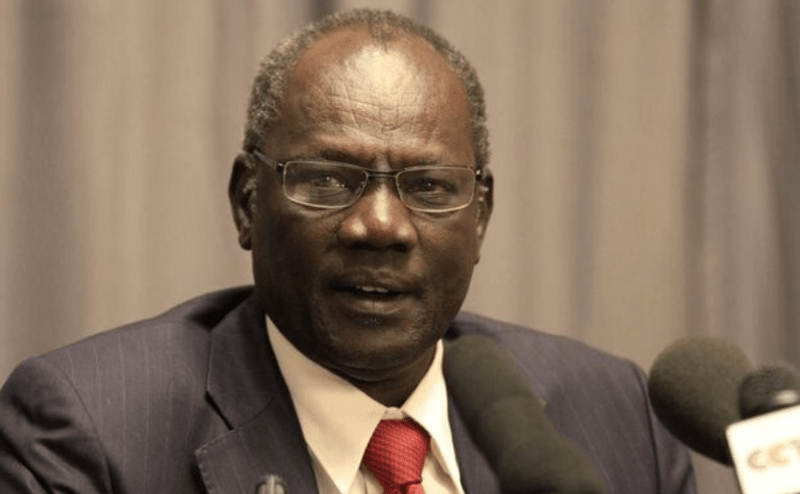

In the public notice on Tuesday, AFA Director General Bruno Linyiru emphasized that the new levies are in line with Regulation 37 of the Crops (Food Crops) Regulations, 2019.

According to KNCCI and CGA, this new levy contradicts the government's efforts to boost export growth, which is essential for stabilising and strengthening the Kenyan Shilling.

Reduced export volumes

They fear that the additional financial burden on farmers and exporters could lead to reduced export volumes and lower foreign exchange earnings.

"The timing of this levy is quite unfortunate," noted Anthony Kioko, CEO of the CGA. "Over the past four years, our cereal exports have been declining, with a slight recovery seen only in 2023. Introducing an export levy now would stifle this recovery, undermining the hard work of our farmers and exporters," reads the statement in part.

As a result, the organisations are calling for clarity on the recently introduced import levy.

"We need to understand whether these levies apply to imports from the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA). Such levies could potentially negate the benefits of our regional trade agreements," they said.

They have also urged the government to reconsider the imposition of this export levy and to engage in constructive dialogue with stakeholders in the agricultural sector.

"We believe that through collaborative efforts and open dialogue, we can achieve solutions that align with our national objectives and promote the welfare of our farmers and the broader economy. It is crucial to explore alternative measures that can enhance our export capabilities without imposing undue burden on our farmers and exporters," reads the statement.

The new levies according to AFA, are part of the government's plan to increase its revenue.

Once effected, for roots and tubers, the import tax is set at 1.0 per cent, with a 0.3 per cent tax on exports.

Legumes and pulses imported into the country will be subjected to a 2.0 per cent customs charge, with exports facing a 0.3 per cent levy.

Still, under the new regulations, cereal imports will incur a 2.0 per cent customs value charge, while exports will be taxed at 0.3 per cent.